How the Supreme Court’s EPA Decision Could Shape the Future of Crypto

How the Supreme Court’s EPA Decision Could Shape the Future of Crypto

This season, the Supreme Court is producing a plethora of headlines and national controversy. Amid the firestorm and fallout, it would be easy for technologists to overlook a recent decision concerning the authority of the Environmental Protection Agency (EPA) to regulate carbon emissions. That would be a mistake.

At first glance, West Virginia v. EPA seems to be about nothing more than a set of effectively obsolete emissions-reduction regulations from 2015, known as the Clean Power Plan. But, upon closer inspection, this case is the latest in a series of judicial decisions that are fundamentally changing the rules of the game for regulatory agencies across the federal government. Setting aside the merits of the Court’s decision, it’s important to map the potential implications of this sea change for technology policy.

First, some background: West Virginia v. EPA involved a group of states and power companies challenging the legality of the 2015 Clean Power Plan, which set nationwide carbon dioxide emissions standards for power plants and required plants take steps to meet them. In its simplest form, the dispute boiled down to whether Congress, in passing a particular statute 50 years ago, properly gave the EPA authority to establish the Clean Power Plan in the first place.

At the top of the Constitution, Article I, Section 1 reads: “All legislative Powers herein granted shall be vested in a Congress of the United States.” Over the years, Congress has passed a range of statutes setting up federal agencies like the Food and Drug Administration (1906), the Federal Trade Commission (1914), and the Securities and Exchange Commission (1934). At the same time, the Supreme Court has decided a number of cases interpreting Article I, Section 1. In the early 20th century, these co-developments culminated in a legal theory called the nondelegation doctrine, which says that, “Congress is not permitted to abdicate or to transfer to others the essential legislative functions with which it is thus vested.” Put simply, Congress must make the law (pass statutes), and agencies must execute that law.

Of course, it turns out to be a bit more complicated than that: Congress sometimes passes laws with broad language or loosely defined terminology; other times, Congress explicitly directs federal agencies to create regulations with more technical details down the line. The complexity of our society and economy have caused courts to interpret the nondelegation doctrine liberally over the past hundred years — and to largely defer to agencies on the grounds that they possess more specialized knowledge of certain subject matter within their domain. As the dissent explained in West Virginia v. EPA:

Members of Congress often can’t know enough—and again, know they can’t—to keep regulatory schemes working across time. Congress usually can’t predict the future—can’t anticipate changing circumstances and the way they will affect varied regulatory techniques. Nor can Congress (realistically) keep track of and respond to fast-flowing developments as they occur. Once again, that is most obviously true when it comes to scientific and technical matters. . . . Over time, the administrative delegations Congress has made have helped to build a modern Nation.

In practice, agencies in the executive branch such as the SEC, CFTC, and many others have played an increasingly consequential role in shaping freestanding bodies of regulation. Collectively, these rulemaking agencies are sometimes referred to as the administrative state.

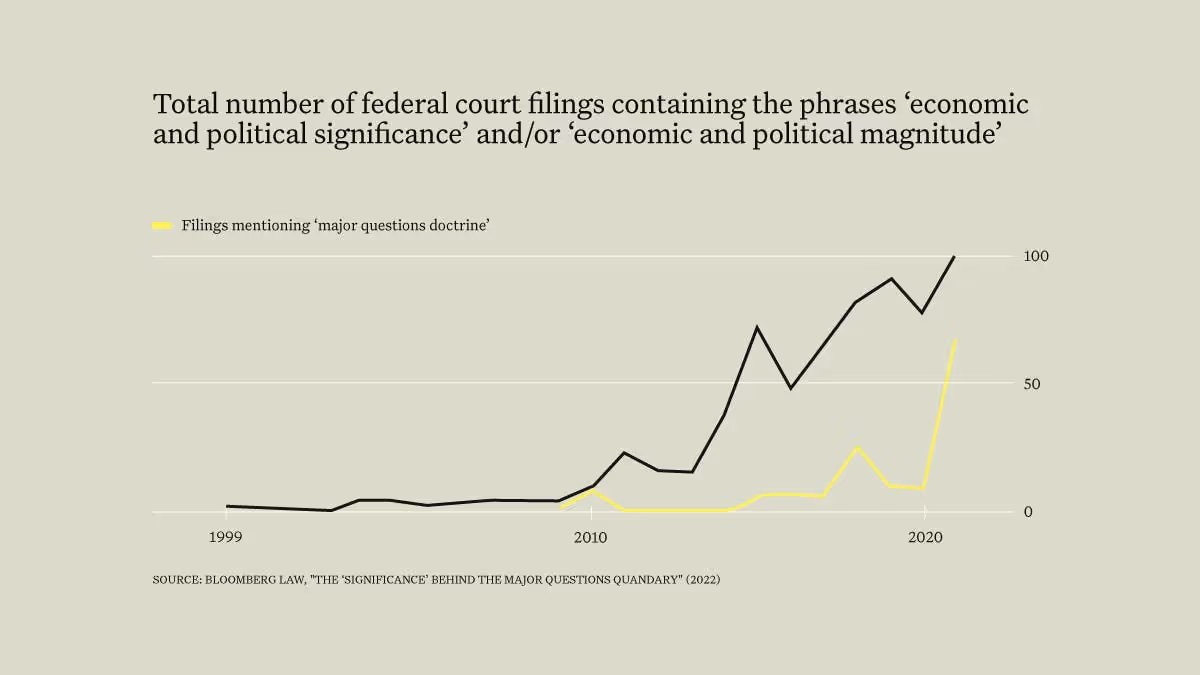

The expansion of the administrative state in the 20th century hasn’t been without its critics among academics and jurists, including some current members of the Supreme Court. These critics have produced another legal theory: the major questions doctrine. The major questions doctrine says that Congress must make a clear statement if it wants to give an agency authority to make decisions of “great economic and political significance.” This doctrine is emerging as an important force in the world of administrative law by breathing new life into the nondelegation doctrine.

Applying the major questions doctrine, the Supreme Court in West Virginia v. EPA held in a 6-3 decision that Congress had not provided clear authority for the EPA to pursue the Clean Power Plan. Nationwide energy production and usage is a matter of “great economic and political significance,” the majority explained, which would have required Congress to unequivocally empower the EPA to implement this particular regulatory program. Moreover, the Court reasoned, the Clean Power Plan proposed by the EPA was similar to regulatory schemes that Congress “had already considered and rejected numerous times.” Overall, the Court highlighted its skepticism towards the notion that a regulatory agency could “discover in a long-extant statute an unheralded power representing a transformative expansion in [its] regulatory authority.” (The three dissenting members of the Court explained how they would have interpreted Congress’ language quite differently and criticized the majority for “announc[ing] the arrival” of the major questions doctrine, which it saw as unprecedented and “tougher-to-satisfy.”)

This majority decision indicates that, at the highest levels, the federal judiciary is increasingly scrutinizing aspects of federal agencies’ plans and rulemaking in the absence of clear congressional action. Although West Virginia v. EPA tackled the enduring problems of climate change and national energy supply, nowhere is this jurisprudential evolution likely to prove more consequential than the regulation of emerging technologies such as web3 — the platinum standard of an industry defined by “fast-flowing development.”

Even at this early stage, web3 is already demonstrating its potential to have “great economic and political significance” by changing Americans’ relationship to technology and capital. Recent polling data shows that over 20% of Americans have now invested in, traded, or used digital assets. The web3 sector is poised to reshape the business model of the internet, along with trillions of dollars in market capitalization; it may likewise transform the landscape of public goods funding, governance, and capital formation.

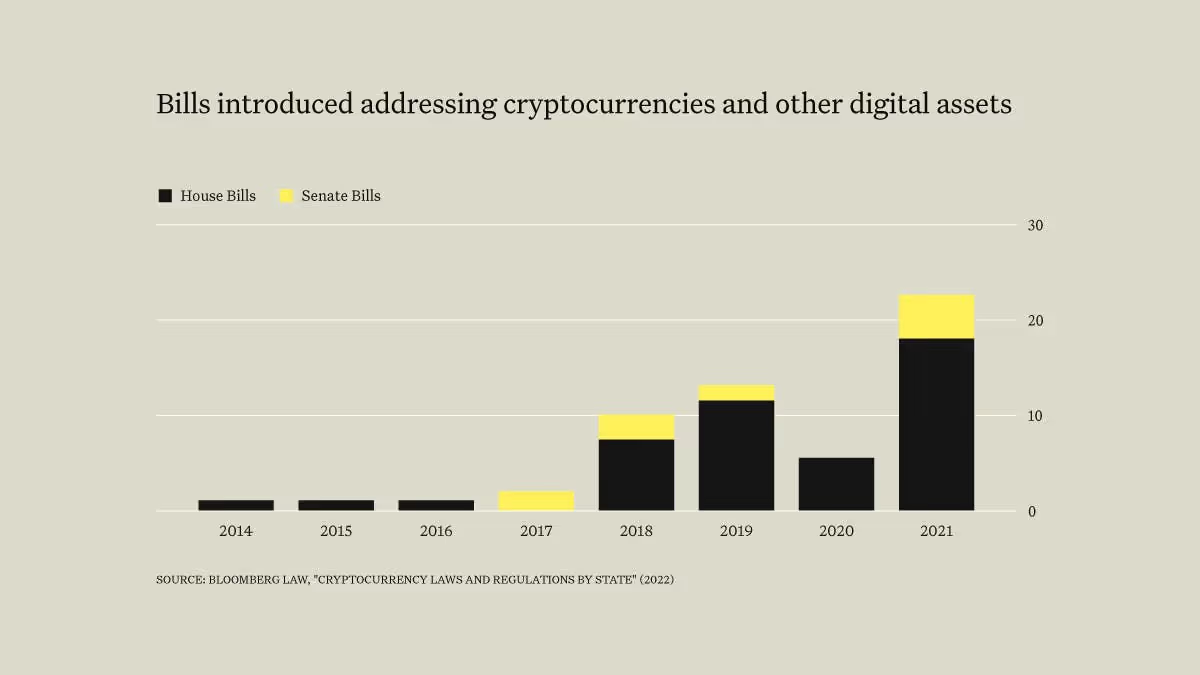

Moreover, web3 is a fundamentally different technology paradigm that sometimes transcends the policy objectives underpinning existing regulatory regimes. To take one example: traditional financial regulation seeks, among other things, to correct information asymmetries between insiders and the public with the goal of putting everyone on equal footing. For web3 projects — many of which are open source and designed to replace corporate intermediaries to ensure that everyone is on equal footing from the outset — the appropriate regulatory architecture is less clear. It is no wonder that Congress has already considered and failed to enact a number of statutes relevant to web3: the Online Market Protection Act of 2014, the Managed Stablecoins are Securities Act of 2019, and the Crypto-Currency Act of 2020, among others.

With the highest court in the land endorsing an expansion of the major questions doctrine, federal agencies will likely take pause. Hermeneutic interpretation of old statutes motivated by old policy objectives has become a less viable path for sweeping regulation of novel technologies that present novel policy questions. Agencies can and should advance regulatory clarity by focusing on issues clearly within their purview, but they may become more careful when Congress has already considered and rejected a proposed regulatory regime. Market participants, litigators, and regulators alike will probably find themselves taking a second look at whether the text of a given statute unambiguously authorizes an agency to take broad measures.

The corollary is that Congress needs to speak clearly in any legislation that grants federal agencies major regulatory or oversight authorities over a new sector. In some instances, Congress may decide that new technologies should still be governed by old rules — but they must explicitly say so. In other instances, they may define a new policy architecture that is fit for purpose, rather than attempting to shoehorn technological breakthroughs into century-old statutory frameworks. Either way, greater statutory and regulatory clarity will benefit all involved.

These political and legal dynamics dramatically increase the importance of the web3 legislative proposals that will likely come before Congress next year. Many leading indicators of future legislative activity are hopeful. Several recent examples of legislation introduced in the Senate (by Senators Stabenow, Boozman, Lummis, Gillebrand, Toomey, Sinema, Warner, and Portman), along with an anticipated stablecoin bill in the House (that will likely be authored by Representatives Maxine Waters and Patrick McHenry), all offer evidence of meaningful bipartisanship, real consultation with stakeholders, and thoughtful efforts to realize the potential of web3 technology. Web3 is the rare domain where Congress could actually deliver bipartisan statutes that match the moment.

As we know from the last century of innovation, well-crafted legislation can empower effective regulation, with vast benefits for American economic prosperity, global influence, and consumers. But successful statutes from the past are not the only roadmap for the future, particularly when it comes to web3, nor is piecemeal rulemaking and enforcement the path to mission-critical policy for the next generation of the internet. Ultimately, we'll need new rules to help govern these new tools.